Latest News

Two cloud titans are pouring cash into AI infrastructure, making them good investments for investors looking to capitalize on the AI boom. But which stock is a better buy?

Via The Motley Fool · December 26, 2025

The 2025 holiday shopping season has proven to be a trial by fire for Nike (NYSE: NKE). As of December 26, 2025, the athletic apparel giant is emerging from a period of intense stock volatility that saw its market capitalization swing by billions in a matter of days. While the

Via MarketMinute · December 26, 2025

As the curtains close on 2025, Tesla, Inc. (NASDAQ: TSLA) has once again defied the skeptics, orchestrating a massive year-end rally that propelled its market capitalization to a staggering $1.6 trillion. Despite fierce global competition and a shifting regulatory landscape for electric vehicles, the Texas-based titan saw its stock

Via MarketMinute · December 26, 2025

SLV, the silver ETF, just traded 2.7 million option contracts in a single session.

Via Talk Markets · December 26, 2025

As the final trading days of 2025 unfold, the semiconductor industry is witnessing a historic transformation, with Micron Technology (NASDAQ: MU) emerging as the vanguard of a massive artificial intelligence "supercycle." Following a blockbuster earnings report released just last week, Micron’s stock has catapulted to all-time highs, reflecting a

Via MarketMinute · December 26, 2025

Choosing between the two stocks likely comes down to one critical factor.

Via The Motley Fool · December 26, 2025

In a move that has sent shockwaves through Silicon Valley and Wall Street, Nvidia (NASDAQ: NVDA) has effectively neutralized its most formidable challenger in the AI inference space. By orchestrating a massive $20 billion "license and acqui-hire" deal with Groq, the startup famed for its ultra-fast Language Processing Units (LPUs)

Via MarketMinute · December 26, 2025

Via Benzinga · December 26, 2025

Via Benzinga · December 26, 2025

As of late December 2025, the financial world is witnessing a historic realignment of asset classes. Gold and silver have not only breached long-standing psychological barriers but have entered a definitive technical breakout phase that has fundamentally altered the relationship between "hard assets" and the traditional equity market. With gold

Via MarketMinute · December 26, 2025

As 2025 draws to a close, the global financial landscape has been reshaped by an unlikely champion. Portugal has officially claimed the top spot in The Economist’s prestigious annual ranking of the world’s best-performing economies, outshining 35 other wealthy nations. Dethroning the 2024 leader, Spain, Portugal’s ascent

Via MarketMinute · December 26, 2025

As we close out 2025, the financial narrative remains firmly gripped by a single, relentless force: the Artificial Intelligence trade. While skeptics at the start of the year predicted a "dot-com style" collapse, the reality on December 26, 2025, is quite the opposite. AI has transitioned from a speculative venture

Via MarketMinute · December 26, 2025

Riot just posted its strongest quarter ever, so why would a concentrated fund head for the exits now?

Via The Motley Fool · December 26, 2025

In a move that signals the definitive shift of global industrial power toward the United States, CRH PLC (NYSE: CRH) officially joined the S&P 500 index on December 22, 2025. This milestone follows a multi-year strategic pivot that saw the building materials giant relocate its primary listing from London

Via MarketMinute · December 26, 2025

NEW YORK — As the final trading week of 2025 unfolds, the S&P 500 (NYSEARCA: SPY) has ascended to breathtaking new heights, fueled by a classic "Santa Claus Rally" that has pushed the benchmark index to a record close of 6,932.18 as of December 26, 2025. This year-end

Via MarketMinute · December 26, 2025

As the sun sets on 2025, the American economy presents a baffling paradox that has left both Wall Street and Main Street in a state of cognitive dissonance. On paper, the United States is entering 2026 in the midst of a "Jobless Boom"—a period of robust GDP growth, surging

Via MarketMinute · December 26, 2025

As we approach the dawn of 2026, the financial landscape is characterized by a rare alignment of growth-oriented factors that have Wall Street analysts increasingly bullish. After a resilient 2025, the market is entering a phase where the "Magnificent Seven" and the broader S&P 500 are no longer relying

Via MarketMinute · December 26, 2025

With satellites about to unlock new capacity and cash flow, one fund appears to be betting that the market still isn’t pricing in what comes next.

Via The Motley Fool · December 26, 2025

In a stunning display of market momentum, silver futures surged 7.7% on December 26, 2025, pushing the "white metal" to historic intraday highs between $75 and $79 per ounce. This dramatic spike caps off a year of unprecedented growth for precious metals, which have transitioned from defensive hedges to

Via MarketMinute · December 26, 2025

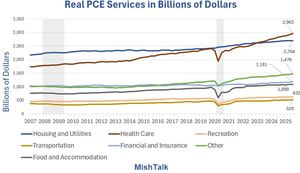

Health care was nearly half of PCE services in Q3. Here’s a breakdown of services.

Via Talk Markets · December 26, 2025

In a move that has sent shockwaves through Silicon Valley and Wall Street, Nvidia (NASDAQ: NVDA) has effectively neutralized its most potent rival in the AI inference space. On December 24, 2025, the semiconductor giant announced a complex $20 billion deal to license the proprietary Language Processing Unit (LPU) technology

Via MarketMinute · December 26, 2025

In a move that underscored the Federal Reserve’s delicate balancing act, the Federal Open Market Committee (FOMC) concluded its final meeting of 2025 on December 10 by delivering a widely anticipated 25-basis-point interest rate cut. This marks the third consecutive quarter-point reduction this year, bringing the federal funds rate

Via MarketMinute · December 26, 2025

The United States economy defied gravity in the third quarter of 2025, delivering a "blowout" growth figure that has fundamentally recalibrated Wall Street’s expectations for the coming year. On December 23, 2025, the Bureau of Economic Analysis released its final reading for Q3, revealing that the U.S. Gross

Via MarketMinute · December 26, 2025

Wondering what's happening in today's after-hours session? Stay tuned for the latest updates on stock movements.

Via Chartmill · December 26, 2025

The online brokerage is still growing like a weed.

Via The Motley Fool · December 26, 2025

Something old, something new, something borrowed, something blue.

Via The Motley Fool · December 26, 2025

Visa is still an evergreen stock for long-term investors.

Via The Motley Fool · December 26, 2025

For long-term investors aiming to build lasting wealth, dividend growth stocks stand out as a powerful choice.

Via Talk Markets · December 26, 2025

The S&P 500 Index ($SPX ) (SPY ) on Friday fell -0.03%, the Dow Jones Industrials Index ($DOWI ) (DIA ) fell -0.04%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) fell -0.05%. March E-mini S&P futures (ESH26 ) fell -0.08%, and March E-mini Nasdaq...

Via Barchart.com · December 26, 2025

Previously 2.65% of fund AUM as of prior quarter; part of broader fund downsizing.

Via The Motley Fool · December 26, 2025

Both ETFs track the S&P 500, but they serve different investor needs. One minimizes long-term costs. The other emphasizes liquidity when execution matters

Via The Motley Fool · December 26, 2025

Via MarketBeat · December 26, 2025

With the right strategy, you can enjoy multiple lucrative income streams.

Via The Motley Fool · December 26, 2025

Gold, silver, platinum, and their miners’ stocks skyrocketed in 2025, multiplying contrarian investors’ wealth.

Via Talk Markets · December 26, 2025

Via Benzinga · December 26, 2025

The QS stock is up by 115% this year, bringing its market capitalization to over $6.7 billion.

Via Talk Markets · December 26, 2025

Elon Musk suggests that AI and robotics could trigger double-digit economic growth in the near term and triple-digit growth within five years.

Via Benzinga · December 26, 2025

After a strong biotech rebound, one fund quietly walked away from sector beta, and the timing says more than the trade itself.

Via The Motley Fool · December 26, 2025

Should you add it to your own portfolio?

Via The Motley Fool · December 26, 2025

Some of the most well-known companies in the world have dropped in 2025, so can they make a comeback?

Via The Motley Fool · December 26, 2025

Via Benzinga · December 26, 2025

The S&P 500 hit fresh all-time highs during Christmas week, Tim Cook bought Nike, and precious metals delivered one of their strongest rallies in decades.

Via Benzinga · December 26, 2025

Via Benzinga · December 26, 2025

Both funds invest in investment-grade corporate bonds, but they sit in very different places on the yield curve. Over time, that distinction determines how each fund moves when interest rates shift

Via The Motley Fool · December 26, 2025

Via Benzinga · December 26, 2025

After a bruising year for the stock, a new institutional buyer is stepping in as Fluor’s cash flow, backlog quality, and capital returns quietly improve.

Via The Motley Fool · December 26, 2025

A lot of crypto money has rushed into silver and other precious metals. A reversion trade will be key, as money from silver and the metals will likely flow back to altcoins in the near-term.

Via Talk Markets · December 26, 2025

The one thing saving the dollar is while the Fed’s bad at inflation, other countries are even worse.

Via Talk Markets · December 26, 2025