With a market cap of $25 billion, ON Semiconductor Corporation (ON) is a global provider of intelligent sensing and power solutions, serving markets across the United States, Europe, and Asia. Operating through its Power Solutions, Analog and Mixed-Signal, and Intelligent Sensing segments, the company delivers advanced semiconductor technologies for automotive, industrial, computing, mobile, and imaging applications.

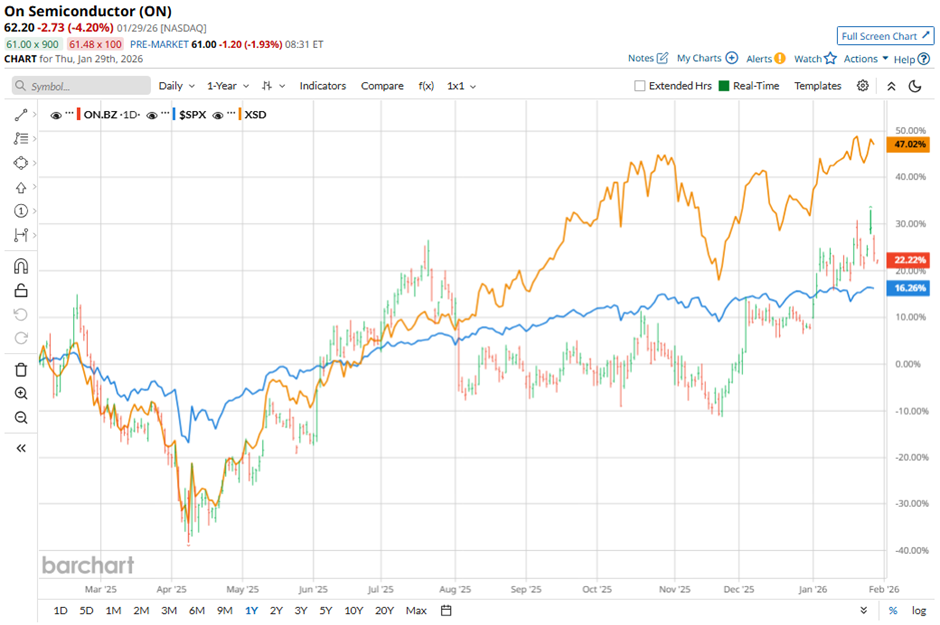

Shares of the Scottsdale, Arizona-based company have slightly outperformed the broader market over the past 52 weeks. ON stock has soared 15.7% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.4%. Moreover, shares of ON are up 14.9% on a YTD basis, compared to SPX’s 1.8% rise.

Narrowing the focus, shares of the semiconductor components maker have lagged behind the State Street SPDR S&P Semiconductor ETF's (XSD) nearly 47% surge over the past 52 weeks.

Shares of ON Semiconductor recovered marginally on Nov. 3 after the company reported Q3 2025 results that exceeded expectations, including revenue of $1.55 billion and adjusted EPS of $0.63. The rebound was also supported by strong demand for its power management chips used in AI data centers, driven by the ongoing artificial intelligence boom. Additionally, the company’s Q4 revenue guidance of $1.48 billion to $1.58 billion and adjusted EPS outlook of $0.57 to $0.67 were largely in line with market expectations, reassuring investors.

For the fiscal year that ended in December 2025, analysts expect ON’s adjusted EPS to decline 40.7% year-over-year to $2.36. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

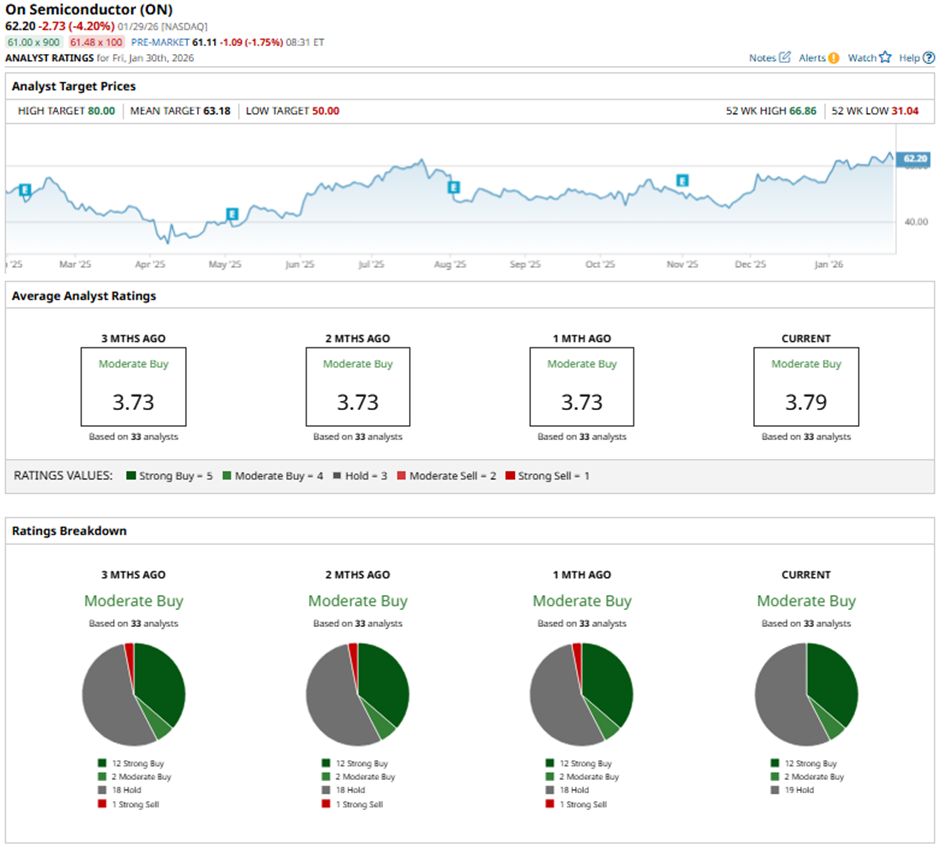

Among the 33 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, two “Moderate Buys,” and 19 “Holds.”

On Jan. 15, Wells Fargo raised its price target on On Semi to $70 and maintained an Overweight rating.

The mean price target of $63.18 represents a 1.6% premium to ON’s current price levels. The Street-high price target of $80 implies a potential upside of 28.6% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart