With a market cap of $13.9 billion, Best Buy Co., Inc. (BBY) is a leading retailer of technology products, appliances, and consumer electronics, operating through physical stores and online platforms in the U.S., Canada, and internationally. It also provides delivery, installation, repair, technical support, and membership services through its stores, websites, and well-known brands such as Best Buy, Geek Squad, Insignia, and Best Buy Health.

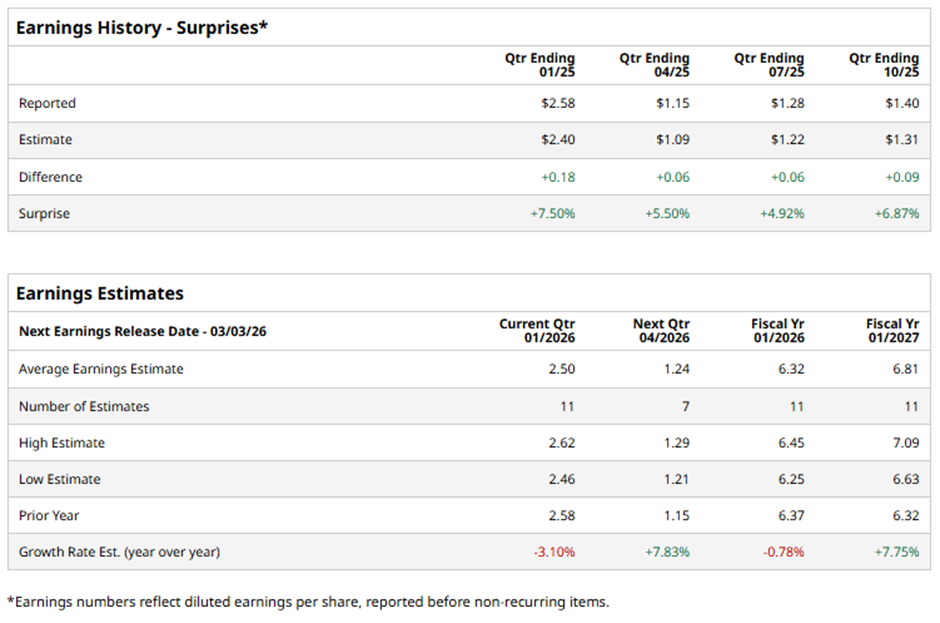

The Richfield, Minnesota-based company is expected to announce its fiscal Q4 2026 results soon. Ahead of this event, analysts expect Best Buy to report an adjusted EPS of $2.50, down 3.1% from $2.58 in the year-ago quarter. However, it has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2026, analysts expect the consumer electronics retailer to report an adjusted EPS of $6.32, a marginal decline from $6.37 in fiscal 2025. However, adjusted EPS is anticipated to grow 7.8% year-over-year to $6.81 in fiscal 2027.

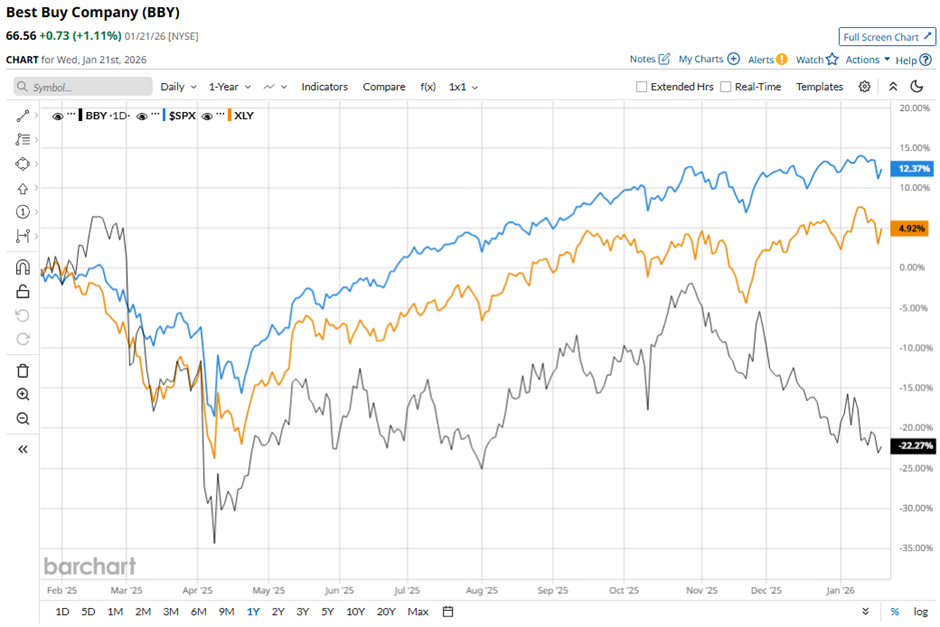

Shares of Best Buy have declined 21.3% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 13.7% gain and the State Street Consumer Discretionary Select Sector SPDR ETF's (XLY) 5.2% return over the period.

Shares of Best Buy jumped 5.3% on Nov. 25 because the company delivered better-than-expected Q3 2026 results, including adjusted EPS of $1.40 and revenue of $9.67 billion. Investors also reacted positively to enterprise comparable-sales growth of 2.7%, driven by strength in computing, gaming, and mobile phones. Confidence grew further after the company raised 2026 adjusted EPS guidance to $6.25 - $6.35.

Analysts' consensus view on BBY stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 24 analysts covering the stock, eight recommend "Strong Buy," 15 indicate “Hold,” and one advises "Moderate Sell." The average analyst price target for Best Buy is $82.31, suggesting a potential upside of 23.7% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- RBC Capital Sees a $550 Billion Reason to Buy These 3 Chip Stocks

- This AI Company Was the Most Shorted Tech Stock in December. Does That Mean a Short Squeeze Is Coming in 2026?

- Wall Street Is Betting Against These 3 Popular AI Stocks. Should You?

- Stifel Is Pounding the Table on Micron Stock for 2026. Here’s Why.